kern county property tax payment

Please type the text from the image. Press enter or click to play code.

Kern County Treasurer And Tax Collector

10 or it will become delinquent.

. You may experience difficultiesslowdowns during this time frame. Proposition 13 - Article 13A Section 2 enacted in 1978 forms the basis for the current property tax laws. On Friday December 10th 2021.

The offices of the Assessor-Recorder Treasurer-Tax Collector Auditor-Controller-County Clerk and the Clerk of the Board have prepared this property tax information site to provide tax payers with an overview of the property tax process in Kern County. Please select your browser below to view instructions. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar.

Various methods of payment are available. We apologize for any inconveniences. Fraud Waste and Abuse in Kern County Government.

Property tax payment deadline moved to May county says. A 10 penalty is. If you inadvertently authorize duplicate transactions for any reason and those duplicate authorizations result in payments returned for insufficient or uncollected funds an additional 27 returned payment fee for each duplicate transaction will be charged.

The postmark of the US. Payment by Visa Mastercard American Express and Discover Card is accepted online 24 hr. The median property tax on a 21710000 house is 160654 in California.

The Kern County Treasurer and Tax Collectors Office is part of the Kern County Finance Department that encompasses all. Kern County has one of the highest median property taxes in the United States and is ranked 606th of the 3143 counties in order of median property taxes. Please write ATNs on your check.

The median property tax on a 21710000 house is 227955 in the United States. Kern County collects on average 08 of a propertys assessed fair market value as property tax. 10 a press release from Kern County Treasurer and Tax Collector Jordan Kaufman said.

System Maintenance has been scheduled on January 2nd 2022 from 8am-3pm. Please enable cookies for this site. 1 Via mail to.

Box 541004 Los Angeles CA 90054. KCTTC PO Box 541004 Los Angeles. Installment Payments Make a payment on a traffic criminal or juvenile dependency case that was previously set up on a payment plan.

You can also pay online. To avoid a 10 late penalty property tax payments must be submitted or postmarked on or before Dec. Find Kern County Property Tax Info From 2021.

Send payments via mail to KCTTC Payment Center PO. Taxpayers may inquire or make payments on their property taxes in person by mail or via the Internet. Secured tax bills are paid in two installments.

Crime Non-Emergency Domestic Violence. The offices of the Assessor-Recorder Treasurer-Tax Collector Auditor-Controller-County Clerk and the Clerk of the Board have prepared this property tax information site to provide tax payers with an overview of the property tax process in Kern County. Ad Search Kern County Records Online - Results In Minutes.

The first installment is due on 1st November with a payment deadline on 10th December. KCTTC Payment Center PO. Box 541004 Los Angeles CA 90054-1004.

Here you will find answers to frequently asked questions and the most commonly requested property. When paying by mail include the payment stubs with your check. Child Abuse or Neglect.

The April 10 property tax deadline has been extended to May 4 due to the coronavirus outbreak according to the Kern County Treasurer-Tax Collector Jordan Kaufman. Postal Service determines the payment date. Box 541004 Los Angeles CA 90054-1004.

Here you will find answers to frequently asked questions and the most commonly requested property. SEE Detailed property tax report for 10804 Thunder Falls Ave Kern County CA. The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law.

The Kern County Treasurer-Tax Collector will present this ACH transaction to your bank for immediate payment. Kern County Treasurer and Tax Collector said that the first installment of Kern County property tax will become delinquent if not paid by 5 pm. Kern County Treasurer-Tax Collector mails out original secured property tax bills in October every year.

Kaufman said the extension is due to the fact that county buildings will be closed to the public through May 1. Cookies need to be enabled to alert you of status changes on this website. A day at wwwkcttccokerncaus A convenience fee will be charged on all card usage.

The median property tax on a 21710000 house is 173680 in Kern County. The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100. The Kern County Treasurer-Tax Collectors Office located in Bakersfield California is responsible for financial transactions including issuing Kern County tax bills collecting personal and real property tax payments.

The Kern County Treasurer and Tax Collector KCTTC is reminding Kern residents that the first installment of property tax is due next weekThe county agency is urging residents to make sure they pay the first installment of their property tax by 5 pm. Property Taxes - Pay Online. You can mail your payments to the Kern County treasurer and tax collector at.

Property Taxes - Pay by Wire. Payments can be made on this website or mailed to our payment processing center at PO.

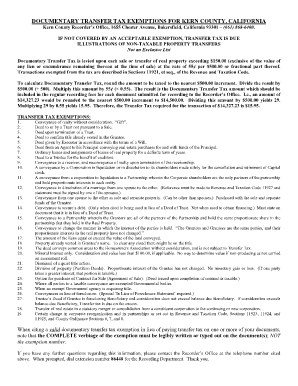

Kern County Property Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Jordan Kaufman Kern County Treasurer Tax Collector Facebook